Goods and Services Tax (GST) Facts You Should Know

The implementation of the Goods and Services Tax (GST) in India was not an overnight thought. The introduction of the tax reform has demanded both time and patience and is expected to significantly affect the Indian economy. The seeds of GST in India was first sown in the year 2000 by Atal Bihari Vajpayee, who was the then Prime Minister of the nation.

A step further in 2005, the then finance minister P. Chidambaram, in his parliament budget session, announced that there was a serious requirement of tax reforms in India in the area of indirect taxation. Next in 2010, the then finance minister, Pranab Mukherjee, in his budget session addressed to the nation that the GST will be introduced in April 2011.

In the budget session of the year 2011, the 115th constitutional amendment bill was introduced in the Lok Sabha for levying the GST on all goods and services, other than some specified goods which were to be kept outside the GST boundary for the benefit of the general public. Ultimately, in 2014, the GST bill was passed in Lok Sabha as the 122nd constitution bill. And in 2016, the bill was passed in the Rajya Sabha as well.

1.It has been 17 years since GST was first conceptualised in India.

That’s right! In the year 2000, the Vajpayee government started a discussion on GST by setting up an empowered committee headed by Asim Dasgupta. He was the then Finance Minister of West Bengal.

2. About 160 countries in the world have the GST.

Presently, there are around 160 countries that have implemented the GST or VAT in some form or the other. France was the first country to have introduced GST.

India, being a federal country, is going to have a dual-GST structure – Central GST and State GST. The only other country with a dual GST is Canada.

3. Rate of GST

Globally, the standard GST rate varies from 1.5% in Aruba to 27% in Hungary.

The GST Council in India has proposed a four-tier rate structure with two standard rates – 12% and 18%, a lower rate of 5% for the essentials and a higher rate of 28% for the luxury goods and sin goods.

The government may even levy a cess on sin goods over and above the higher rate of 28%. The cess will fulfill two purposes – discourage the consumption of sin goods and source additional revenue to compensate the States.

4. The power to levy existing indirect taxes has been removed from the Constitution

On September 16, 2016, when the Constitution was amended to introduce the power to levy GST, the corresponding powers w.r.t. existing indirect taxes were removed, except on a few products which are kept outside the purview of GST for the time being.

So the question arises, how is the government still collecting indirect taxes?

A clause was inserted in the Constitution which provides that the existing taxes will be applicable till 1 year since the date of this amendment.

5. GST cannot be delayed after September 16, 2017

The clause, that provides for the applicability of indirect taxes for 1 year after the above mentioned notification, expires on September 15, 2017.

This means that if GST is not implemented till September 16, 2017, the government would not have power to collect ANY indirect taxes whatsoever till the date GST is implemented.

6. How will GST benefit the economy?

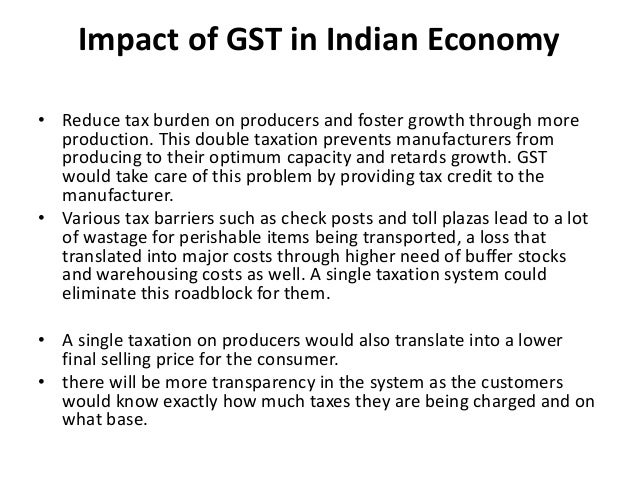

GST will ensure seamless flow of credit across the supply chain, thus overcoming the inflationary effects of cascading of taxes.

Further, GST will open up the Indian economy to FDI by foreign investors who are reluctant to invest in India due to its complicated tax structure.

7. GST is a tax on supply.

The taxable events for the existing indirect taxes are sale, manufacture, provision of service or import. For GST, the taxable event is a supply of goods and/or services. This term covers within its ambit all kinds of existing taxable events.

8. Definition of goods and services under GST

Goods has been defined to mean every kind of movable property. Services have been defined as

“anything other than goods”. If we go by the literal meaning of this definition, even immovable property will be treated as services for the purpose of GST.

“anything other than goods”. If we go by the literal meaning of this definition, even immovable property will be treated as services for the purpose of GST.

9. Free supplies are taxable under GST.

Consideration is not a mandatory condition for a supply to be taxable under GST. Some supplies would be leviable to GST even if no consideration is paid. Schedule I of the Model GST Law provides that the supplies between principal and agent will be taxable even without consideration. So if the principal sends goods to his agent for further sale, it shall be a taxable supply under GST.

10. The Recipient shall be entitled to credit only if the supplier pays tax to the government.

The GSTN system would match the details of tax paid by the supplier to the details of credit claimed by the recipient. In case the recipient claims excess credit, it shall be disallowed automatically till the time the return is rectified.

This system motivates the recipient to keep a check on his supplier. The government has shifted its burden of ensuring compliance of GST system to the recipient of supplies.

0 comments

Please share your thoughts